March is historically the busiest wedding planning month & there are tools to help with finances for the wedding, honeymoon and newlywed life!

Financial Tip Friday is brought to you in partnership with The 1st National Bank of Dennison.

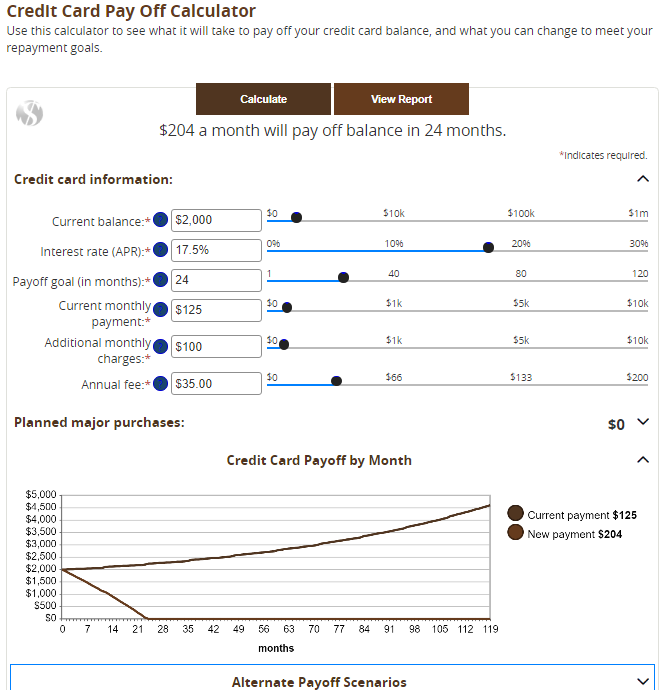

Weddings have become a tremendous strain on the wallet in the past decade but having a financial calculator in hand will help plan out how to prepare, plan and pay off the mounting bills. This will come in handy when deciding how much money to spend on the honeymoon, or if it needs to be skipped to make a downpayment on your home purchase.

Venue, Flowers, Photographer, Food, Invitations, Outfits, Musicians, Rings, Website, Rehearsal, Favors, Welcome Baskets, Hair & Makeup, Music…

Credit Card & Debt

Discuss what personal or student loan debt the two of you will have moving forward and make a plan of attack. If there is no debt- then contenplate how to have money make money in different savings and investments.

Mortgage

Ready to take the next step- getting an apartment, condo, house or investment property together is a likely next stage in life.

-

Bi-Weekly Payment

-

Mortgage Loan

-

Mortgage Tax

-

Adjustable-Rate Mortgage

-

Mortgage APR

-

Reverse Mortgage

-

Mortgage Payoff

-

Mortgage Points

-

Mortgage Qualifier

-

Mortgage Refinance

-

Rent vs. Buy

-

Refinance Savings

-

Mortgage Comparison

Insurance

Insurance changes once married- check these calculators out to help as well!

Check out More Calculator hacks here!

For help with savings, spending, and investing, speak to a local banker to help set up a solid foundation!

to help set up a solid foundation!

Mrs TAZ

Reporting

It would be wonderful if all high schools would teach the options for handling money and opportunities and paths offered by banking. Here’s a crash course list of what one may find at The 1st National Bank of Dennison.

Let’s begin with the 1874 Origin Story.

Plan for retirement and know –IRA Options.

Plan for retirement and know –IRA Options.

Grasp the ability to afford a plentiful Christmas with Christmas Club.

Grasp the ability to afford a plentiful Christmas with Christmas Club.